As India accelerates its electric vehicle (EV) journey, a critical resource challenge threatens to slow down its progress—lithium. Recently, Maruti Suzuki Chairman RC Bhargava voiced his concern over how lithium imports could become a major bottleneck in EV manufacturing.

According to Bhargava, the lithium import impact on EV battery making is an issue that cannot be overlooked, especially as India aspires to become a global leader in electric mobility.

Lithium is a core component of the batteries that power EVs, and currently, India is heavily dependent on foreign sources for its supply. With limited domestic reserves and rising global demand, the challenges surrounding lithium procurement are intensifying.

In this TazaJunction.com article, we will dive into why Bhargava’s remarks are significant, the consequences of lithium dependency, and what it means for the future of India’s EV industry.

Table of Contents

The Strategic Role of Lithium in EV Batteries

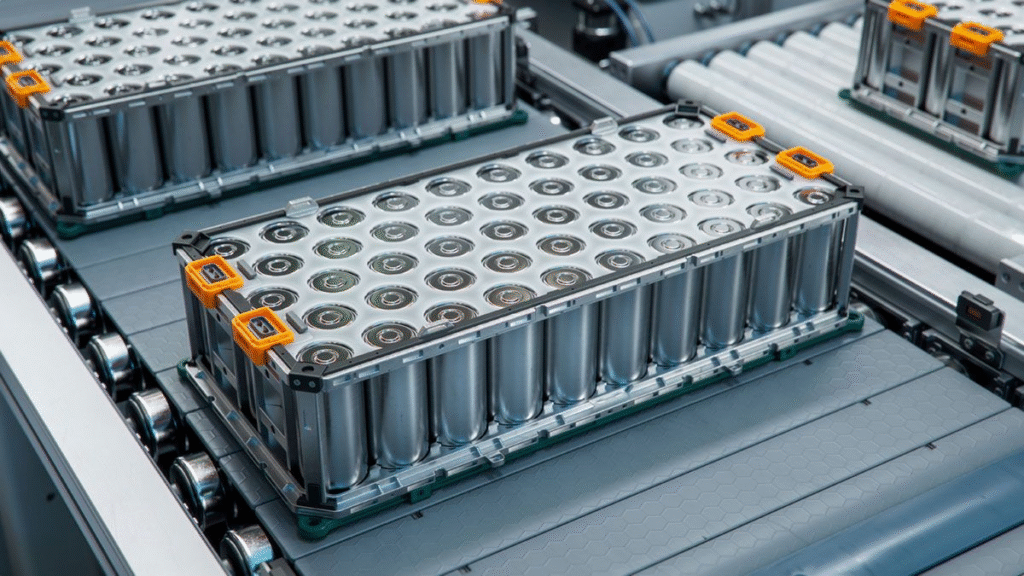

Lithium-ion batteries are the backbone of the electric vehicle ecosystem. These batteries offer high energy density, long charge cycles, and lightweight profiles, making them ideal for powering EVs.

But the raw material—lithium—is scarce and concentrated in just a few regions worldwide, primarily Australia, Chile, and China.

As Bhargava pointed out, the lithium import impact on EV battery making will become more apparent as demand surges. Without a stable and affordable lithium supply chain, battery manufacturing could face delays, cost hikes, or even stagnation.

For automakers like Maruti Suzuki, which are gradually stepping into the EV segment, this creates uncertainty in long-term planning.

Maruti’s Stance on the EV Supply Chain

Maruti Suzuki, India’s largest carmaker, has traditionally taken a conservative approach toward EV adoption. While the company has begun investing in EV R&D, its leaders have often highlighted the need for cost-efficiency, consumer readiness, and infrastructure support.

RC Bhargava’s statement brings another dimension into the spotlight—the lithium import impact on EV battery making from a supply chain and economic standpoint.

He emphasized that while local battery assembly is a step forward, it won’t be sustainable without indigenous access to key minerals like lithium. Bhargava also hinted that relying too heavily on imports would not only increase costs but expose the industry to geopolitical risks and foreign market fluctuations.

Current Lithium Dependency in India

India imports almost all of its lithium, primarily in the form of lithium carbonate and lithium hydroxide. These compounds are processed and used in battery packs for EVs, smartphones, and renewable energy storage.

Despite rising demand, India’s domestic lithium production remains negligible. Recent explorations in Jammu & Kashmir and Karnataka have revealed potential lithium reserves, but they are still in the early stages of evaluation. Until commercial mining begins, the lithium import impact on EV battery making will continue to be a pressing concern.

This heavy reliance on imports not only affects cost and availability but also raises questions about long-term energy security. For a country pushing for self-reliance under the “Atmanirbhar Bharat” initiative, this dependency runs counter to the broader goal.

Economic Impact on EV Battery Manufacturing

The economics of EV battery manufacturing are deeply intertwined with raw material costs. Lithium constitutes a significant portion of battery expense, and fluctuations in international lithium prices can directly affect the final cost of EVs.

If lithium prices rise or availability becomes restricted, manufacturers may be forced to pass these costs onto consumers. This could slow down adoption, especially in a price-sensitive market like India.

Bhargava’s concerns underscore how the lithium import impact on EV battery making could derail affordability—a key driver of EV acceptance in India.

Furthermore, high import costs also reduce the competitiveness of Indian-made EVs in the global market. Countries with easier access to lithium or better recycling ecosystems will likely have a cost advantage.

Technological and Strategic Solutions

While the challenges are real, there are also multiple ways India can address the lithium import impact on EV battery making in the years ahead:

1. Domestic Mining Exploration

India has already taken steps toward identifying domestic lithium sources. Commercially viable lithium mines could eventually reduce import dependency, though such efforts require time and significant investment.

2. International Partnerships

Securing lithium supply through strategic partnerships and long-term contracts with lithium-rich countries can help stabilize costs and guarantee availability.

3. Battery Recycling

As EVs become more common, the development of battery recycling ecosystems can help recover lithium from used batteries, reducing the need for fresh imports.

4. Alternate Battery Technologies

R&D in alternative battery chemistries, such as sodium-ion or solid-state batteries, may reduce the reliance on lithium altogether. This would minimize the lithium import impact on EV battery making in the long term.

Policy Support and Government Role

Government policy will play a crucial role in mitigating the lithium import impact on EV battery making. Initiatives such as the Production-Linked Incentive (PLI) scheme for battery manufacturing and Faster Adoption and Manufacturing of Electric Vehicles (FAME) have already laid the groundwork.

However, more targeted policies are needed. These may include:

- Special incentives for domestic lithium exploration and processing

- Import duty restructuring to balance costs

- Financial support for recycling startups and clean-tech innovators

- Guidelines to standardize battery packs for reuse and recycling

The government must also work in tandem with private companies to create a resilient and scalable battery ecosystem.

What It Means for Consumers?

Ultimately, the lithium import impact on EV battery making will affect everyday consumers. If raw material prices remain volatile and supply uncertain, EV prices may not come down as quickly as expected. This could delay mainstream adoption, especially in rural and semi-urban areas.

By addressing this challenge early, India can ensure that EVs remain affordable and accessible to a larger section of society. Reducing import dependency will also mean fewer disruptions in production, resulting in better availability and service for end-users.

Industry Reactions and the Way Forward

Bhargava’s comments have resonated across the auto industry. Several automakers and battery suppliers echoed his concerns, stating that while India has made progress in EV readiness, the issue of critical mineral supply must now take center stage.

Some companies are already investing in lithium supply chains abroad, while others are exploring in-house recycling units. Industry leaders agree that collaboration between automakers, battery firms, and government agencies is essential to mitigate the lithium import impact on EV battery making effectively.

The next few years will be crucial. As EV demand grows exponentially, so will the need for a reliable, local, and sustainable supply of battery components.

Conclusion

RC Bhargava’s warning about the lithium import impact on EV battery making is more than a cautious observation—it’s a strategic insight into one of the most pressing challenges facing India’s electric vehicle revolution.

Without a secure and affordable lithium supply, India’s dreams of becoming a global EV powerhouse may face serious roadblocks. Addressing this issue requires immediate, coordinated efforts—from policy reforms and domestic mining to international partnerships and technology innovation.

If India can successfully reduce its lithium import dependency, it will not only boost EV production but also strengthen its position in the global clean energy landscape.