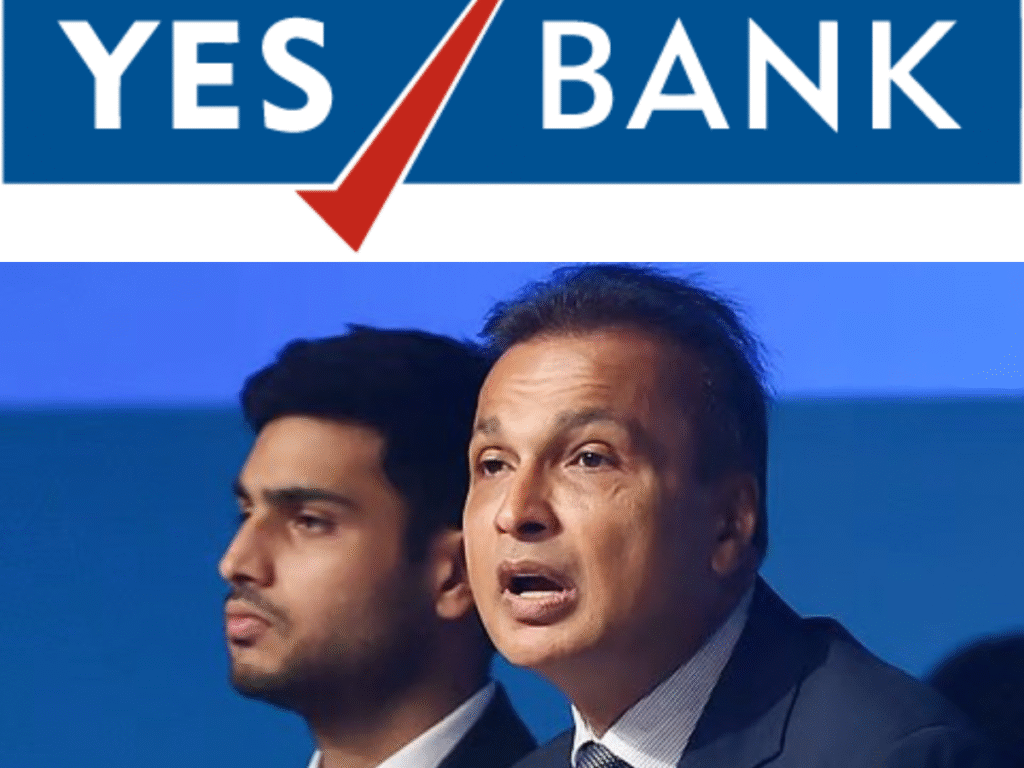

In a dramatic turn of events, the Enforcement Directorate (ED) carried out a major operation across multiple locations connected to Anil Ambani’s Reliance Group in July 2025. The ED raid covered over 35 premises and implicated more than 50 companies across India.

The move came after serious allegations of a ₹3,000 crore loan fraud involving Yes Bank and a series of transactions that hinted at money laundering and financial mismanagement.

The raids have shaken investor confidence and brought back attention to corporate governance and financial accountability in India’s high-profile conglomerates.

This Tazajunction.com article examines the reasons behind the ED raid, its implications on the Reliance Group, and what it could mean for the broader business landscape in India.

Table of Contents

Background of the ED Investigation

The foundation for the ED raid lies in a case that dates back to the period between 2017 and 2019, when Yes Bank allegedly extended large loans to companies associated with Anil Ambani’s Reliance Group.

According to official reports, these loans—amounting to over ₹3,000 crore—were disbursed without adequate due diligence and were later suspected of being diverted through a complex web of shell companies.

The Enforcement Directorate launched the investigation under the Prevention of Money Laundering Act (PMLA), following two FIRs filed by the Central Bureau of Investigation (CBI). These FIRs pointed to fraudulent practices in loan disbursement, fund diversion, and possible bribery of Yes Bank officials.

Also check Reliance Industries Q1 Result for the first quarter of the financial year 2025-26.

Scope of the ED Raid

The ED raid was conducted simultaneously at corporate offices, personal residences of key executives, and locations associated with financial consultants tied to the group. The scale of the operation suggests a significant level of suspicion regarding financial irregularities.

Key areas of focus during the raids included:

- Loan sanction documents

- Financial statements from 2017 to 2021

- Digital evidence, including emails and internal communications

- Contracts with shell companies and third-party service providers

- Transaction trails showing movement of funds from Yes Bank to end recipients

Sources familiar with the investigation indicated that authorities were also examining whether these loans were evergreened—that is, paid off using funds borrowed from other lenders to avoid default.

Allegations of Fund Diversion

The central allegation is that substantial portions of the loans sanctioned by Yes Bank were funneled through shell companies. These entities had little to no actual business operations and were primarily set up to route money to various accounts, some allegedly linked to individuals with close ties to Anil Ambani.

Investigators claim the purpose of this scheme was to launder money and create an illusion of operational expenditure or capital investment, when in reality the funds may have been used to cover debt obligations, pay off personal liabilities, or maintain liquidity within other troubled entities in the group.

The Role of Yes Bank

The ED raid also puts Yes Bank’s earlier leadership under renewed scrutiny. The bank’s former promoters are accused of colluding with borrowers and approving loans without proper risk assessment.

In some cases, the same collateral was allegedly used multiple times, and standard credit rating protocols were bypassed.

There are also suggestions that some loans were approved within unusually short timeframes, and in return, the promoters of the bank may have received financial benefits through personal accounts or third-party intermediaries.

Reliance Group’s Response

Anil Ambani’s Reliance Group issued a formal statement shortly after the ED raid, stating that the group was cooperating fully with the authorities. It emphasized that the companies under investigation had repaid the loans in question and that all transactions were fully compliant with applicable banking regulations at the time.

The group also clarified that Anil Ambani, in his personal capacity, had no executive role in the companies being investigated during the time the loans were sanctioned. This distancing strategy appears to be aimed at protecting Ambani’s personal reputation, though legal experts suggest that the distinction may not hold if authorities find evidence of overarching control or benefit.

Financial and Market Impact

The announcement of the ED raid had an immediate impact on the stock market. Shares of Reliance Infrastructure and Reliance Power saw sharp declines, with investors worried about prolonged legal battles and reputational damage.

Credit rating agencies also placed some group companies under review, citing uncertainty around future cash flows and corporate governance risks.

Analysts noted that even if the allegations are eventually proven unsubstantiated, the negative publicity alone could hinder fundraising efforts, deter institutional investors, and lead to tighter scrutiny from regulators and lenders.

Governance and Audit Red Flags

Prior to the ED raid, several red flags had already been raised by regulatory bodies and auditors. SEBI had previously restricted some group companies from accessing capital markets due to concerns over misstatement of financials.

A forensic audit commissioned by a consortium of banks had highlighted inconsistencies in accounting, questionable third-party payments, and poor disclosure practices.

These findings may have added momentum to the ED’s investigation, making a strong case for direct intervention to secure physical and digital evidence before it could be destroyed or manipulated.

Legal and Compliance Ramifications

Under the PMLA framework, the ED is authorized to attach properties, freeze bank accounts, and arrest individuals if there is reasonable belief that the proceeds of crime have been concealed or laundered. The agencies may also seek custodial interrogation of key executives if the evidence justifies it.

If convicted, the penalties could include significant fines, long-term disqualifications from managing companies, and even imprisonment.

Beyond the legal consequences, a conviction could destroy public trust in the brand and permanently damage investor sentiment toward Anil Ambani–led ventures.

Long-Term Implications

The ED raid has broader implications for corporate India. It highlights the growing willingness of regulators to act swiftly and publicly against powerful promoters and high-profile companies. It also reinforces the need for stronger internal controls, independent board oversight, and transparency in corporate borrowing.

For the Reliance Group, this could mean a prolonged period of restructuring, tighter scrutiny from lenders, and potential divestment of non-core assets to maintain solvency.

Some industry experts suggest that this episode could also trigger a shift in public markets toward companies with stronger governance track records and lesser promoter dependency.

Public Perception and Media Coverage

Public reaction to the ED raid has been mixed. While some view it as a long-overdue crackdown on financial crime, others caution against media trials that may undermine due process. What’s clear, however, is that the credibility of major business houses now increasingly depends not just on performance, but also on perceived integrity.

The government, too, is under pressure to show that enforcement actions are not selective and that similar scrutiny is applied across sectors, regardless of political or business connections.

Conclusion

The ED raid on Anil Ambani’s Reliance Group–linked companies represents a significant development in India’s fight against financial irregularities and corporate fraud.

Triggered by alleged irregularities in ₹3,000 crore worth of loans from Yes Bank, the investigation could reshape how regulators, investors, and the public view promoter-led conglomerates.

While the full legal outcome is yet to unfold, the immediate consequences are already visible—falling stock prices, rising compliance costs, and growing skepticism in capital markets.

For Reliance Group, this is not just a legal battle but a test of its ability to regain credibility, restore investor confidence, and rebuild its financial reputation in the years to come.