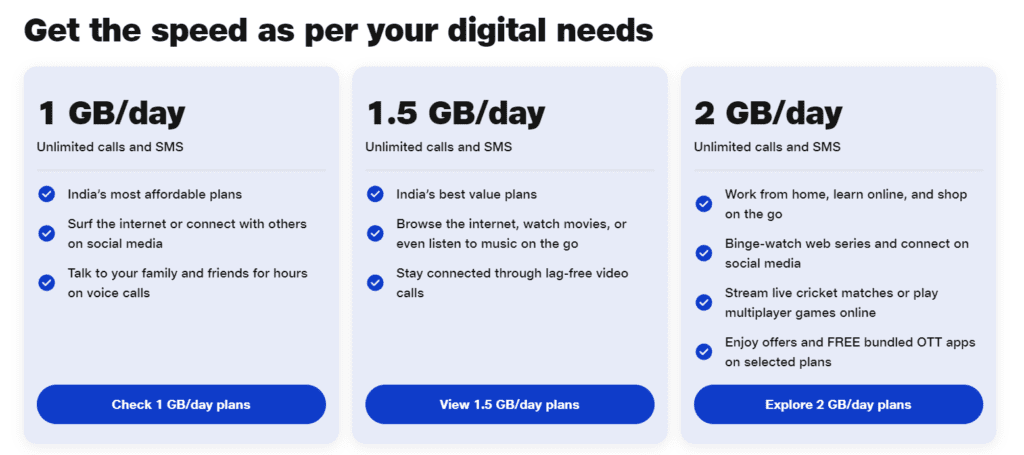

Reliance Jio has transformed India’s telecom landscape by offering high-speed data, unlimited calling, and bundled app subscriptions at prices that suit every budget.

While premium plans often grab attention, the real value lies in Jio’s 5 most affordable plans under Rs 350, which cater to students, professionals, and everyday users who want maximum benefits without overspending.

These plans strike the perfect balance between cost and features, offering daily data, unlimited calls, SMS, and access to Jio’s suite of apps.

In this TazaJunction.com article, we’ll break down each of these five plans, compare their benefits, and help you decide which one best fits your needs.

Table of Contents

Why Affordable Plans Matter?

India is one of the world’s largest mobile data consumers, and affordability is a key driver of this growth. With millions of users depending on mobile internet for work, education, and entertainment, Jio’s 5 most affordable plans under Rs 350 ensure that connectivity remains accessible to all.

These plans are not just about saving money—they’re about enabling digital inclusion. Whether it’s attending online classes, streaming cricket matches, or staying connected with family, these budget-friendly options make sure no one is left behind.

Jio’s 5 Most Affordable Plans Under Rs 350

Plan 1: Rs 198 Plan

The Rs 198 plan is the entry point in Jio’s 5 most affordable plans under Rs 350. It offers:

- Data: 2 GB per day

- Validity: 14 days

- Calls: Unlimited voice calls

- SMS: 100 per day

- Extras: Access to JioTV, JioCinema, and JioCloud

This plan is ideal for short-term users who need heavy data for a couple of weeks, such as students preparing for exams or professionals traveling for work.

Plan 2: Rs 239 Plan

Next in line is the Rs 239 plan, which balances affordability with slightly longer validity.

- Data: 1.5 GB per day (total 33 GB)

- Validity: 22 days

- Calls: Unlimited voice calls

- SMS: 100 per day

- Extras: JioTV, JioCinema, JioCloud

Among Jio’s 5 most affordable plans under Rs 350, this one is perfect for moderate users who want nearly a month of connectivity without spending too much.

Plan 3: Rs 299 Plan

The Rs 299 plan is one of the most popular choices in Jio’s 5 most affordable plans under Rs 350 because it offers a full month of benefits.

- Data: 1.5 GB per day (total 42 GB)

- Validity: 28 days

- Calls: Unlimited voice calls

- SMS: 100 per day

- Extras: JioTV, JioCinema, JioCloud

This plan is a sweet spot for regular users who want consistent data and calling benefits for an entire billing cycle.

Plan 4: Rs 329 Plan

The Rs 329 plan is slightly higher in price but comes with added perks, making it a strong contender in Jio’s 5 most affordable plans under Rs 350.

- Data: 1.5 GB per day (total 42 GB)

- Validity: 28 days

- Calls: Unlimited voice calls

- SMS: 100 per day

- Extras: JioSaavn Pro, JioTV, JioCloud

The inclusion of JioSaavn Pro makes this plan attractive for music lovers who want ad-free streaming along with their daily data.

Plan 5: Rs 349 Plan

The Rs 349 plan is the premium option among Jio’s 5 most affordable plans under Rs 350, offering the best mix of data and additional benefits.

- Data: 2 GB per day (total 56 GB)

- Validity: 28 days

- Calls: Unlimited voice calls

- SMS: 100 per day

- Extras: JioTV, JioCinema, JioCloud, plus festive offers like Zomato Gold or JioHotstar trials (subject to availability)

This plan is perfect for heavy data users who stream videos, attend online meetings, and use multiple apps daily.

Comparing the Five Plans

Here’s a quick comparison of Jio’s 5 most affordable plans under Rs 350:

| Plan | Price | Data/Day | Validity | Extras |

|---|---|---|---|---|

| Rs 198 | 2 GB | 14 days | JioTV, JioCinema | Short-term heavy users |

| Rs 239 | 1.5 GB | 22 days | JioTV, JioCinema | Moderate users |

| Rs 299 | 1.5 GB | 28 days | JioTV, JioCinema | Regular users |

| Rs 329 | 1.5 GB | 28 days | JioSaavn Pro, JioTV | Music lovers |

| Rs 349 | 2 GB | 28 days | JioTV, JioCinema, festive offers | Heavy data users |

Who Should Choose Which Plan?

- Students: The Rs 198 or Rs 239 plans are budget-friendly for short-term needs.

- Working Professionals: The Rs 299 plan provides a reliable monthly cycle.

- Music Enthusiasts: The Rs 329 plan is tailored for those who want JioSaavn Pro.

- Heavy Streamers: The Rs 349 plan is the best choice for binge-watchers and gamers.

By tailoring your choice to your lifestyle, you can maximize the value of Jio’s 5 most affordable plans under Rs 350.

Why These Plans Stand Out?

Several factors make Jio’s 5 most affordable plans under Rs 350 stand out in the crowded telecom market:

- Balanced Pricing: Each plan is carefully priced to suit different user segments.

- Daily Data Allotments: Instead of lump-sum data, users get daily allowances, ensuring consistent usage.

- Unlimited Calls: Voice calling remains truly unlimited, a major advantage over some competitors.

- App Ecosystem: Free access to JioTV, JioCinema, and JioCloud adds entertainment and utility value.

- Flexibility: With validity ranging from 14 to 28 days, users can pick what suits their budget and usage.

The Bigger Picture

The affordability of these plans reflects Jio’s broader mission: to make digital connectivity accessible to every Indian. By offering Jio’s 5 most affordable plans under Rs 350, the company ensures that even budget-conscious users can enjoy high-speed internet, entertainment, and communication without compromise.

This strategy not only strengthens Jio’s market dominance but also contributes to India’s digital transformation, where affordable internet is a key enabler of growth.

Conclusion

In today’s digital-first world, staying connected is no longer optional—it’s essential. With Jio’s 5 most affordable plans under Rs 350, users get the perfect mix of data, calls, SMS, and entertainment at prices that don’t strain their wallets.

Whether you’re a student, a professional, or a heavy streamer, there’s a plan tailored for you. By choosing wisely, you can ensure uninterrupted connectivity, entertainment, and productivity—all under Rs 350.