China continues to stake its claim as a global AI powerhouse, and nothing showcased that ambition more vividly than the recent China AI summit, where the stars of the show weren’t scientists—but robots.

From agile humanoids performing backflips to robot boxers dodging and jabbing in real time, the event pushed the boundaries of artificial intelligence, robotics, and human-machine interaction.

This year’s China AI summit, held in Shanghai, drew more than 80,000 attendees and hundreds of exhibitors, making it the largest AI focused conference the country has ever hosted.

What stood out wasn’t just the scale but the energy, spectacle, and undeniable technological prowess on display.

Table of Contents

Robots Take Center Stage

The highlight of the China AI summit was undoubtedly the robotic demonstrations. Instead of static product displays or algorithm charts, tech companies wowed the crowd with live, choreographed performances featuring humanoid robots with astonishing agility and reflexes.

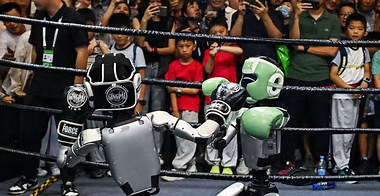

One of the biggest crowd-pullers was a boxing match between two bipedal robots equipped with vision sensors, real-time motion tracking, and predictive AI software.

Spectators were treated to actual sparring matches where the robots ducked, countered, and even feinted—a showcase of how far robotic control systems have advanced.

Another jaw-dropping moment came when a humanoid robot executed a series of standing backflips with the precision of a trained gymnast. Powered by a proprietary AI motion planning system, the robot adjusted to slight changes in surface friction and orientation, impressing even the most skeptical engineers.

These displays weren’t just gimmicks; they served as real-world demonstrations of applied AI, mobility algorithms, and responsive feedback systems working in harmony.

Focus on Human-Robot Collaboration

One of the key themes of the China AI summit was human-robot collaboration. Several exhibits highlighted scenarios in which robots worked alongside people in industrial, medical, and public service environments.

In one demo, a robotic arm assisted a human surgeon in performing a simulated operation, responding to voice commands and visual cues with sub-millimeter accuracy.

In another, humanoid guides helped visitors navigate the massive venue using real-time language translation and facial recognition.

These real-time interactions weren’t staged—they were powered by AI systems trained on vast datasets and designed for seamless, intuitive communication. Organizers emphasized that the future of AI in China is not just about automation but about cooperation between humans and intelligent machines.

China’s AI Push Gains Momentum

The China AI summit came at a time when the country is accelerating its efforts to dominate AI research and commercialization. With billions invested annually in AI startups, university programs, and industrial deployments, China is no longer playing catch-up—it’s setting the pace.

Government officials speaking at the summit reiterated China’s goal to become the world leader in AI by 2030. The event showcased not just domestic talent but global partnerships, signaling China’s intent to lead on both innovation and policy.

From robotics to autonomous vehicles to machine learning platforms, the China AI summit revealed a thriving ecosystem of entrepreneurs, researchers, and state-backed ventures working toward that vision.

AI Meets Entertainment

While AI is often viewed through the lens of science and productivity, the China AI summit also celebrated its entertainment potential. Attendees could visit pavilions where robots played instruments, danced to popular songs, or performed acrobatics with synchronized LED visuals.

One robot was programmed to freestyle rap based on audience input, while another recreated traditional Chinese opera gestures using motion capture and generative AI. These efforts showcased a fusion of cultural preservation and high-tech creativity that resonated with both older and younger generations.

The integration of AI into entertainment is part of a broader effort to humanize technology, making it less intimidating and more relatable to the public.

Education and Youth Involvement

A significant portion of the China AI summit was devoted to education, youth engagement, and talent development. Schools and universities participated in coding challenges, robot-building competitions, and AI ethics workshops designed to inspire the next generation of engineers and developers.

High school students demonstrated their own AI-powered inventions, from emotion-detecting smart mirrors to environmental sensors that monitored air quality in real time. The summit’s organizers stressed that nurturing homegrown talent is essential to sustaining China’s AI ambitions.

Through partnerships with educational institutions, tech firms are investing in STEM education and hands-on AI training programs that begin as early as primary school.

Global Participation, Local Ambitions

Though focused on domestic achievements, the China AI summit drew participants from over 40 countries. Delegations from Europe, the U.S., South Korea, and the Middle East attended, some as collaborators, others as curious observers of China’s fast-paced AI trajectory.

While geopolitical tensions remain in the background, the summit provided a neutral ground for dialogue, knowledge sharing, and business development. Startups from various countries pitched their technologies to Chinese investors, seeking both funding and market entry.

The global nature of the event reflects a growing recognition that, despite competition, collaboration remains key in solving some of the world’s biggest challenges—many of which AI is well-positioned to address.

Ethics and Governance in Focus

No major AI event is complete without discussion on ethics, and the China AI summit was no exception. Panels explored AI bias, privacy concerns, surveillance technology, and the future of work. Chinese academics and policymakers spoke about building a framework of “trustworthy AI” that balances innovation with societal well-being.

Although China’s regulatory approach differs from that of the West, the summit highlighted an increasing awareness of the need for responsible AI development. There were also proposals for international cooperation on AI governance, especially in areas like autonomous weapons, healthcare, and misinformation detection.

Corporate Showcases and Tech Debuts

The China AI summit also served as a launchpad for several high-profile tech debuts. Leading Chinese tech firms unveiled their latest AI chips, neural processing units, and robot control systems.

One major announcement came from a startup that introduced a fully autonomous warehouse robot capable of navigating dynamic environments without external sensors.

Electric vehicle companies also used the platform to reveal advancements in AI-assisted driving. Several showcased new models that integrate real-time traffic prediction, adaptive route planning, and voice-based navigation—all powered by domestic AI platforms.

Economic and Strategic Implications

Beyond technology, the China AI summit underscored the strategic role of AI in national planning. With supply chains shifting and global competition intensifying, China is positioning AI as a pillar of economic growth and geopolitical influence.

Analysts believe that China’s model—where government, academia, and industry align closely—offers certain advantages in scaling AI deployment rapidly. However, it also raises concerns about centralized control and the ethical risks of surveillance-driven models.

Still, there’s no denying that events like the China AI summit signal China’s long-term commitment to integrating AI into every aspect of its economy and society.

Final Thoughts

The China AI summit was more than a tech exhibition—it was a statement of intent. The boxing and backflipping robots may have provided the visual spectacle, but the real message was clear: China is not just participating in the global AI race—it aims to lead it.

From breakthrough demos and international dialogue to youth engagement and ethical discussions, the summit painted a picture of a nation rapidly transforming its technological landscape.

If the innovations displayed are any indication, the future of AI will have a distinctly Chinese accent.