Artificial Intelligence has long been associated with software—chatbots, recommendation engines, and data analysis tools. But the next frontier is already here: AI that doesn’t just think but acts in the real world.

The latest breakthrough from Google DeepMind, Gemini Robotics 1.5 brings AI agents into the physical world, represents a monumental step forward in merging digital intelligence with physical capability.

This article explores what Gemini Robotics 1.5 is, how it works, its potential applications, and what it means for the future of robotics and human-AI collaboration.

Table of Contents

The Evolution of AI into Robotics

For decades, AI was confined to virtual spaces—solving problems, analyzing data, and generating content. Robotics, on the other hand, focused on mechanical engineering and automation.

The challenge was always integration: how to give robots the intelligence to adapt, learn, and interact naturally with the physical world.

Now, with the announcement that Robotics 1.5 brings AI agents into the physical world, we are witnessing the convergence of these two domains.

This is not just about robots following pre-programmed instructions; it’s about machines that can perceive, reason, and act with autonomy.

What is Gemini Robotics 1.5?

Gemini Robotics 1.5 is the latest iteration of Google DeepMind AI-driven robotics platform. It combines advanced machine learning models with robotic hardware, enabling robots to perform delicate, complex, and context-aware tasks.

The fact that Gemini Robotics 1.5 brings AI agents into the physical world means that these systems are no longer limited to simulations or controlled environments. They can now interact with real-world objects, environments, and even humans in meaningful ways.

Key Features of Gemini Robotics 1.5

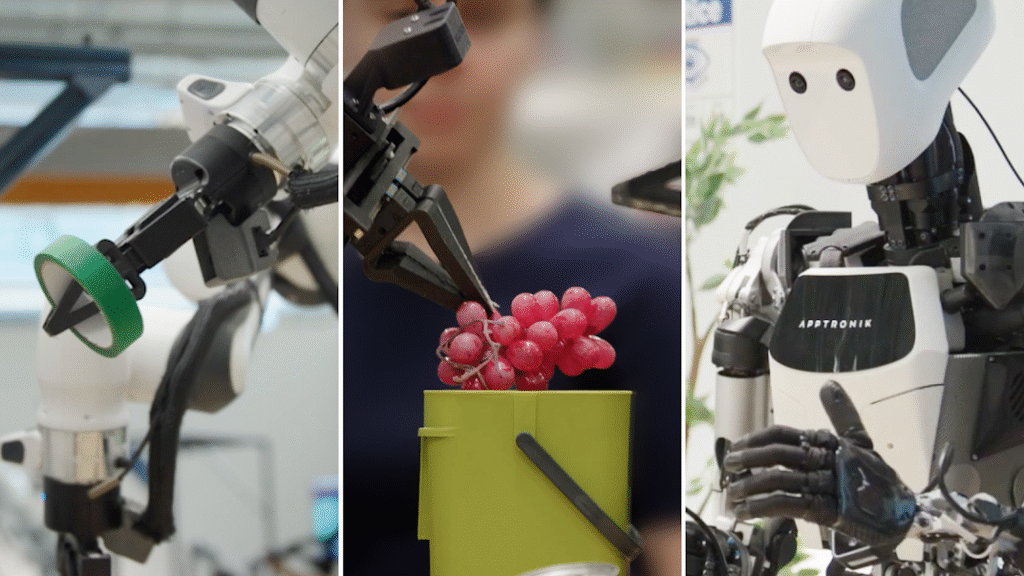

- Advanced Perception: Using computer vision and multimodal AI, the robots can recognize objects, understand spatial layouts, and adapt to dynamic environments.

- Fine Motor Skills: Demonstrations show robotic grippers handling delicate items like grapes without crushing them.

- Human-Robot Interaction: Humanoid prototypes can interpret gestures, respond to commands, and collaborate with people.

- Adaptive Learning: Robots can learn from experience, improving performance over time.

These capabilities are why the phrase Gemini Robotics 1.5 brings AI agents into the physical world is so significant—it signals a leap from theory to practice.

Applications Across Industries

The potential applications of Gemini Robotics 1.5 are vast:

- Healthcare: Assisting in surgeries, elderly care, and rehabilitation.

- Manufacturing: Performing precision assembly tasks and quality control.

- Agriculture: Harvesting crops with delicacy and efficiency.

- Logistics: Sorting, packing, and delivering goods in warehouses.

- Domestic Use: Helping with household chores and caregiving.

The fact that Gemini Robotics 1.5 brings AI agents into the physical world means these applications are no longer futuristic concepts—they’re becoming practical realities.

Handling Delicate Objects

One of the most impressive demonstrations of Gemini Robotics 1.5 is its ability to handle fragile items like grapes. Traditional robots often struggle with such tasks because they require nuanced pressure control and sensory feedback.

By showing that Gemini Robotics 1.5 brings AI agents into the physical world with the ability to manipulate delicate objects, DeepMind has proven that AI-driven robots can achieve levels of dexterity once thought impossible.

Human-Robot Collaboration

Robots are not meant to replace humans but to work alongside them. Gemini Robotics 1.5 emphasizes collaboration, with humanoid robots designed to understand human cues and assist in shared tasks.

This collaborative approach is why Gemini Robotics 1.5 brings AI agents into the physical world is such a milestone—it’s about creating partners, not just machines.

Ethical and Social Considerations

With great power comes great responsibility. As Gemini Robotics 1.5 brings AI agents into the physical world, questions arise about ethics, safety, and employment.

- Safety: Ensuring robots can operate without harming humans.

- Privacy: Managing data collected by AI-driven robots.

- Jobs: Balancing automation with human employment opportunities.

- Regulation: Establishing frameworks for responsible deployment.

These considerations must be addressed to ensure that the benefits of Gemini Robotics 1.5 are realized without unintended consequences.

The Role of AI in Physical Intelligence

AI has already proven its worth in cognitive tasks, but physical intelligence is a new frontier. The ability to perceive, plan, and act in real-world environments requires a fusion of machine learning, robotics, and human-centered design.

The fact that Gemini Robotics 1.5 brings AI agents into the physical world shows that we are entering an era where machines can not only think but also act with precision and purpose.

Competitive Landscape

Other companies are also exploring AI-driven robotics, from Boston Dynamics’ agile machines to Tesla’s humanoid prototypes. However, DeepMind’s Gemini Robotics 1.5 stands out because of its integration of cutting-edge AI models with practical robotic applications.

This is why the announcement that Gemini Robotics 1.5 brings AI agents into the physical world has captured global attention—it represents a unique blend of intelligence and embodiment.

Future Possibilities

Looking ahead, Gemini Robotics 1.5 could pave the way for even more advanced systems:

- Fully Autonomous Service Robots in homes and offices.

- Disaster Response Robots capable of navigating dangerous environments.

- Space Exploration Robots assisting astronauts on missions.

The fact that Gemini Robotics 1.5 brings AI agents into the physical world is just the beginning of a much larger journey.

Challenges Ahead

Despite the excitement, challenges remain:

- Cost: High development and production costs may limit accessibility.

- Scalability: Moving from prototypes to mass production is complex.

- Trust: Building public confidence in AI-driven robots will take time.

Still, the momentum is undeniable. The reality that Gemini Robotics 1.5 brings AI agents into the physical world shows that these challenges are being actively addressed.

Conclusion

The launch of Gemini Robotics 1.5 is more than just a technological milestone—it’s a glimpse into the future of human-AI interaction. By combining intelligence with embodiment, DeepMind has created robots that can perceive, adapt, and collaborate in ways that were once science fiction.

The headline says it best: Gemini Robotics 1.5 brings AI agents into the physical world. This breakthrough marks the beginning of a new era where AI is no longer confined to screens and servers but becomes an active participant in our daily lives.

As we move forward, the challenge will be to harness this power responsibly, ensuring that AI-driven robots enhance human life while respecting ethical boundaries.

If done right, Gemini Robotics 1.5 could be remembered as the moment when artificial intelligence truly stepped into the real world.